We have updated our Privacy Policy, click here for more information.

Thank you

Published: October 2, 2023

After emerging from the vast array of changes included in Phase I of the CFTC Rewrite last year, you would be forgiven for thinking that switching product identifiers in CFTC Rewrite Phase II, and subsequently for EMIR REFIT, will be a breeze. You may be surprised.

‘Unique Product Identifiers’ (UPIs) are a complex system of standardization which will be an integral part of trade capture, data processing and transaction reporting for over-the-counter (OTC) derivatives, and they will become the baseline product identifier for G20 financial supervision. However, whilst UPI is the new focus, International Securities Identification Numbers (ISINs) are not going anywhere.

While keeping ISIN flows intact, many systems will need to build the capability to consume and publish UPI data. Additionally, upstream systems may need to request new UPIs on a trade-by-trade basis. Given the interdependent complexity of regulatory requirements and trade repository validation rules, it will be challenging to avoid a new wave of submission rejections and technology issues.

While Exchange Traded Derivatives (ETD) remain reportable using ISINs, market regulators are looking to enforce UPI requirements upon OTC derivatives. A UPI code will be assigned to each OTC derivative product and will contain specific values that together describe the product. Each product identifier and related reference data will be stored in a UPI reference data library, administered by a globally appointed UPI service provider.

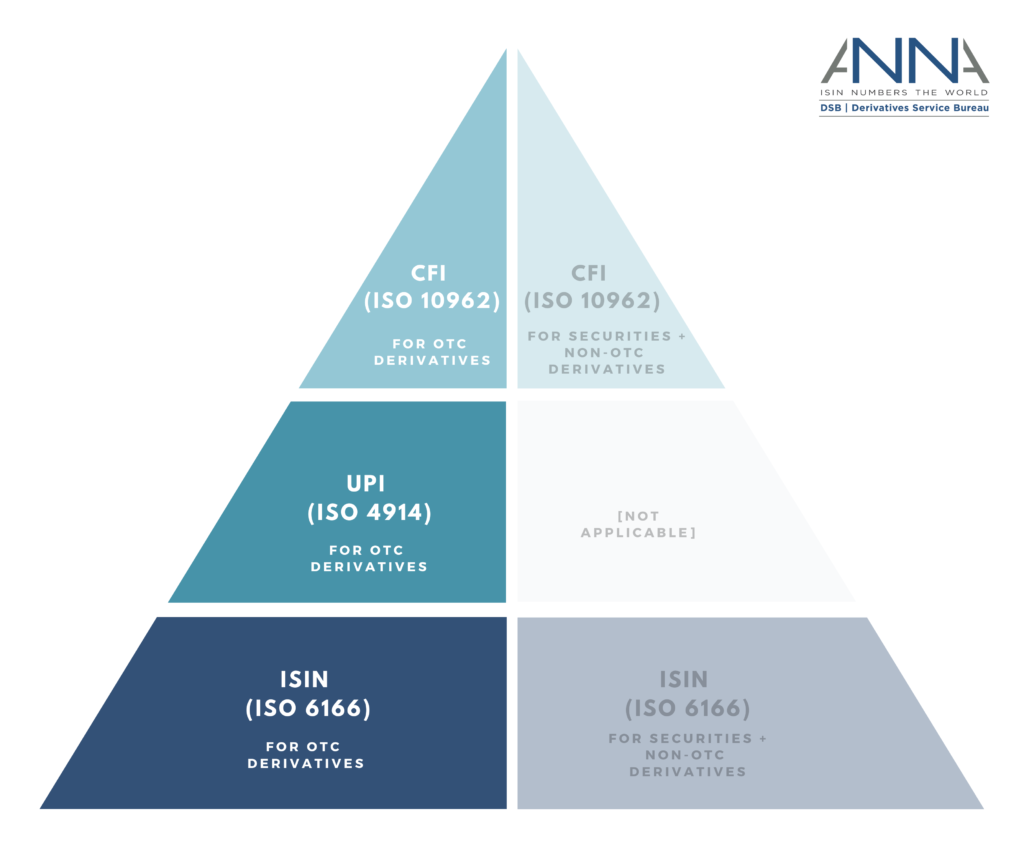

The Derivatives Service Bureau (DSB), founded by the Association of National Numbering Agencies (ANNA), has been designated as the sole global UPI service provider of UPI codes and the UPI reference data library. DSB is also the sole source of other ISO standards such as ISINs, Classification of Financial Instruments Codes (CFIs), and Financial Instrument Short Names (FISNs).

The following diagram of ANNA-DSB ISO standards highlights the granularity of each standard with ISINs, the most granular, at the base of the triangle and CFIs, the least granular, at the triangle’s peak:

Live UPIs can be created in and sourced from ANNA-DSB starting on October 16, 2023, and to ensure a smooth holiday season, this is when trade capture and securities applications should look to go live. By this time, upstream systems should have their own library of UPI templates and when a new identifier is needed, they should be able to request and receive it from ANNA-DSB within a moment’s notice.

Most firms will treat UPI as a trade attribute stored upstream, but there is also the option of purely building in the reporting engine, bearing in mind that identifier data will not be available to upstream consumers. Regardless of how the data is consumed, the flow of UPI attribute data will be important, and some identifier attributes will be used by trade repositories to validate submissions. In such cases, if the attributes (e.g., Instrument Type, Delivery Type, Underlying Asset Type) of existing UPIs do not synchronize with the reported transaction attributes, the submission will be rejected. Ensuring identifiers and respective attributes align throughout the reporting flow will be critical on day 1 and will continue to be important as new UPIs are continuously created. Based on current OTC ISIN data, ANNA-DSB estimates over 100 million UPIs will be populated ahead of CFTC go-live (January 29, 2023), and 5 thousand will be created every month after.

April 17, 2023: ANNA-DSB UAT environment launched

October 16, 2023: ANNA-DSB to have live UPI data in production

January 29, 2024: CFTC compliance date for UPI requirements

April 29, 2024: EMIR REFIT compliance date for UPI requirements

Many firms will face unexpected challenges with their UPI implementation and go-live. Here are some of the key challenges we anticipate:

When there are new reporting validations, ‘negative acknowledgements’ (NACKs) are soon to follow. Here are some of the ways in which our consultants and analysts can apply lessons learned to ensure a smooth implementation:

The scope of regulatory change seen this year in the OTC derivatives space is unprecedented. First Derivative is here to help firms pioneer the new regulatory landscape safely and quickly. No surprises; just quality regulatory solutions.

|

Thomas Kapp |