We have updated our Privacy Policy, click here for more information.

Thank you

TCO: Making Technology Work Harder for You

In today’s competitive business landscape, optimising technology investments is crucial. Understanding the true Total Cost of Ownership (TCO) is no longer an option – it’s a necessity. Discover how to gain a deeper understanding of your technology spend and unlock significant cost savings.

CIOs report a constant pressure to do more with less; to operate a model where cost optimisation is a constant, not a one-off activity; to shift the balance of spend from “run” to “change”; to meet high expectations on the delivery of business value; to deal with many layers of technological and organisational complexity; and to reduce the footprint of legacy technology.

Over the last two decades, the overall cost of running a technology estate has risen. Different banks have dealt with this in different ways, but all have faced the same pressure of rising Total Cost of Ownership. Many of these applications are mission critical; books and records, and traded risk platforms often requiring support in time zone aligned countries or ‘on desk’ elements.

Nearshore and far shore resourcing solutions produced a one-off cost benefit but often at the expense of higher inflation, service quality reduction and team size inflation.

The monolithic architecture of most commercial off-the-shelf (“COTS”) applications forces organisations to remain in a waterfall-based delivery model, sometimes with a downward spiral of upgrade efficiency.

In a fast moving, highly dynamic business, like capital markets, the ability to change and a bank’s rate of change are important factors in remaining competitive. Over the last few years, the technology world has changed, embracing agile and moving towards DevOps with the rate of change in technology on an upward trajectory. Those living with waterfall-based technology are at a disadvantage with their rate of change typically on a downward trajectory.

CIOs are being forced to spend a larger proportion of their budgets on run versus change

Source: FCA, 2024

Where the total cost of ownership is rising, even change activity is dominated by regulation and maintenance

Source: TechTarget Review of 938 Global Firms, 2024

Over 90% of firms are still weighted down by legacy applications and infrastructure

Source: FCA, 2024

Chris Trainor and Leon Orr unpack how our team applies the Total Cost of Ownership (TCO) framework to help clients reduce costs, simplify operations, and deliver meaningful business outcomes.

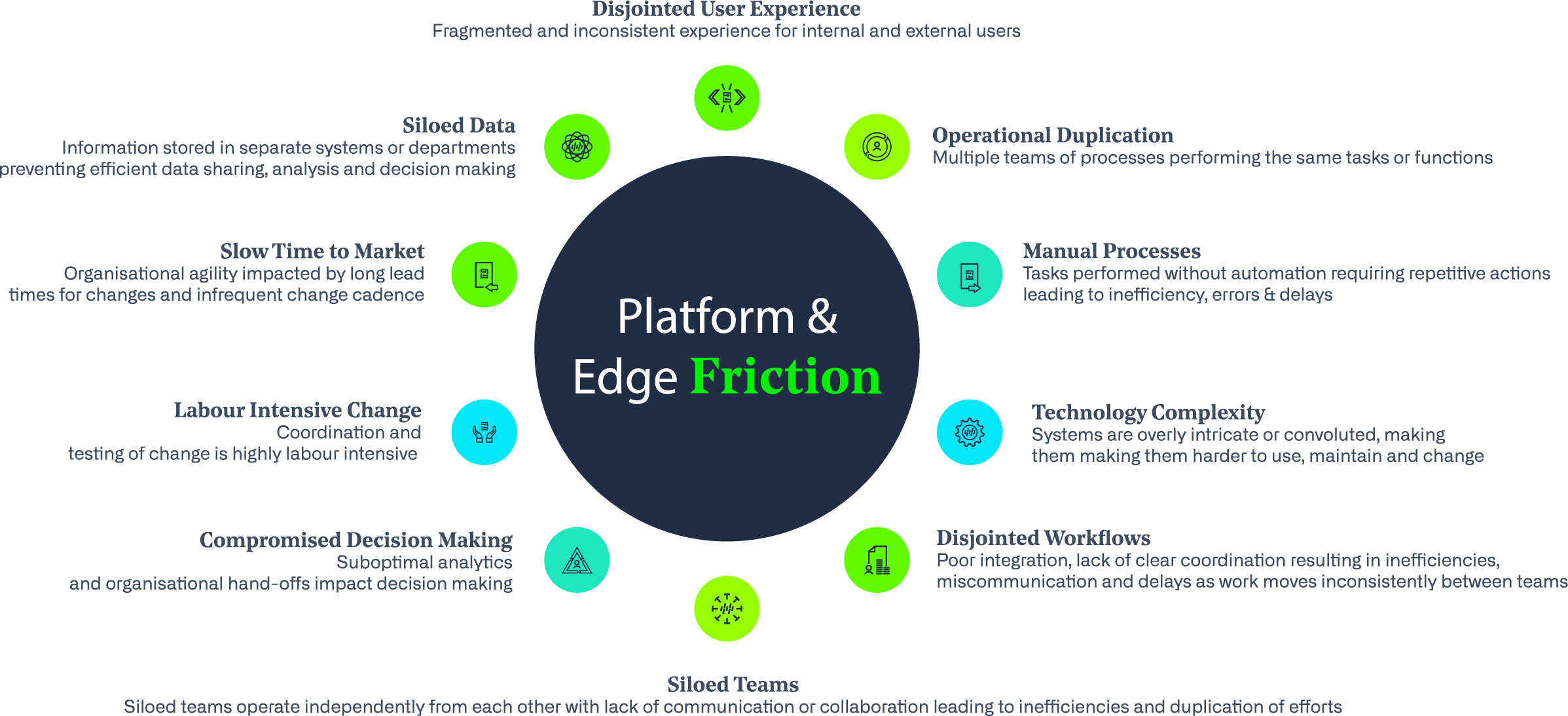

Friction in the platform and edge elements negatively impacts total cost of ownership and business value. This ranges from operational duplication, manual processes, unnecessary complexity and impaired user experience.

Review Costs holistically

Classify the elements of the Foundation and Platform to determine the support structure that maximises value

Define an Edge strategy to optimise cost and business value

There are many levers in commercial off the shelf (COTS) and in-house developed proprietary applications for TCO reduction. The starting point is to understand the TCO for each of the applications taking account of costs that emerge at different stages of their lifecycle

COTS application owners frequently report ‘buyer regret’ but when we delve into this it becomes apparent that the application does 80+% of its intended functionality well but what we are calling ‘the Edge’ carries most of the dissatisfaction. Understanding how business functionality is being serviced is key to environment performance

Design of support services is dependent on application tier and the nature of that application. Elite DevOps has taught us a lot about how you gain efficiency (doing more with less), while the comparison between bespoke microservices based applications and typically monolithic COTS is stark, it is possible to adapt many of the DevOps lessons to shorten service chains and target higher service levels. Some of this is about tooling and process, much is about team organisation and culture

Application creates competitive advantage

Application critical but not a market differentiator

Application to be retired

Business Outcomes

Maximise Business Outcomes

Stabilise Business Outcomes

Minimise Business Outcomes until Decommission

Total Cost of Ownership

Optimise Total Cost of Ownership

Minimise Total Cost of Ownership

Minimise Total cost of ownership until Decommission

Support

Support is an integral part of high performing DevOps team structures

Support and change run as a hyper efficient, SLA-driven shared service

Minimisation of costs while maintaining minimal compliance standards and data integrity

Infrastructure

Infrastructure optimised to maximise performance and reduce time to market

Minimisation of the infrastructure costs by unpicking contractual complexity whilst maintaining SLAs

Minimisation of infrastructure costs via decommission factory

A modern capital markets technology architecture is designed to support the high demands of trading, data processing, and regulatory compliance in a fast-paced environment. The architecture typically features a modular and scalable setup, allowing firms to quickly adapt to changing market conditions and regulatory requirements.

At the core, it relies on cloud & hybrid computing, DevOps and microservices for flexibility and scalability. The platforms enable firms to manage large volumes of market data and execute complex analytics in real-time. Microservices, structured around independent functional components, help ensure efficient system updates without disrupting the entire infrastructure.

APIs (Application Programming Interfaces) are crucial for connecting internal applications and integrating third-party data sources, allowing seamless communication between various components. Big data analytics platforms are used to store and analyze vast amounts of market, trade, and customer data, supporting advanced data-driven decision-making.

Security and compliance layers are integrated to meet stringent regulatory standards, particularly around data protection and transparency. Firms are also adopting artificial intelligence and machine learning to automate decision-making, optimize trading strategies, and detect potential fraud.

Overall, this architecture focuses on flexibility, security, and the ability to process and analyse massive datasets efficiently, helping firms stay competitive.

First Derivative helped its client reduce total cost of ownership (TCO) for a portfolio of over fifty applications by 50% and reduced complexity within the portfolio by 40%.

First Derivative is eager to help you navigate your journey and provide the support and expertise to comprehend the complexities and challenges that organisation your might have.